What are some ways to preserve cash flow? Most financial leaders prefer to use cash flow to tell whether a company's in a good financial situation.

Cash flow refers to the difference in a business's cash balance from one period to the next. Net income is a company's gross income minus any expenses within an accounting period. Here are answers to frequently asked questions about cash flow: What's the difference between cash flow and net income?

#Cash flow positive definition how to#

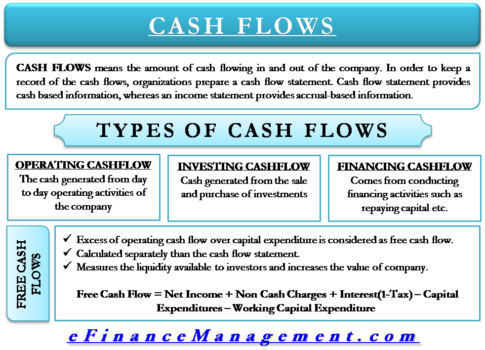

Related: Step-by-Step Guide on How To Create a Cash Flow Statement Frequently asked questions about cash flow Here's an example of a company's cash flow statement: Related: How To Calculate Dividend Yield (With Formula) Example of a cash flow statement Financing activities may also include activities that can impact an organization's long-term liabilities and equities, such as the sales or repurchase of company stock. They may include cash from investors and cash to shareholders in the form of dividends. These activities include the cash that supports the company's operations. A company may have negative cash flow from its investing activities if it's working to build its long-term prosperity. It can also include loans to suppliers and payments from mergers or acquisitions. This type of cash flow includes purchases or sales of assets such as land, buildings, equipment or marketable securities. Related: What Are Business Activities? Definition and 3 Types 2. A business also considers items like depreciation on equipment or other tangible assets, amortization of intangible assets and deferred tax as part of its operating activities. Operating activities can also include payment from customers, the purchase of inventory, accounts payable and company payroll. For example, if a company sells a product, then the production, sales and delivery are different operating activities. These are the activities that are the core business activities. Here's an explanation of the three main sections of a cash flow statement: 1. Related: 6 Essential Accounting Skills 3 sections of a cash flow statement

The net change in cash: This is the difference in cash flow from one accounting period to another. įree cash flow to the firm: This measurement assumes that a company has no debt, and you can use it to determine a company's valuation. It doesn't include investment income.įunding gap: The funding gap is how much cash a company needs to overcome a deficiency.ĭividend payments: Businesses use this type of cash flow to pay dividends to investors.Ĭapital expenditures: This is how much cash flow a company uses to reinvest in itself and improve its operations.įree cash flow to equity: This is the cash flow from operating activities subtracted by capital expenditures. Liquidity: Liquidity determines how well a company can meet its financial obligations.Ĭash flow per share: The cash flow per share is the amount of a company's after-tax earnings divided by its outstanding shares.Ĭash conversion ratio: This ratio measures the time between when a business pays for inventory and when it receives payment from a customer.Ĭash flow from operating activities: This is the cash that a company's primary activities generate. Net present value: Net present value is the value of a business using the discounted cash flow. Below are some of the types of cash flow on a financial statement: Net profit + depreciation - accounts receivable - increases in inventory + accounts payable - decreases in bank loans/financing = net cash flow Types of cash flowĬash flow is part of the financial statement of a company.

The general formula for converting profit into cash flow is as follows: A cash flow statement, a document a business uses to track cash flow, may help an organization decide on future endeavors, such as business acquisitions, employee recruitment and additional benefits for the firm. For example, understanding a company's cash flow can help it consider future expenses or respond to changes in the economic client. It also helps the organization prepare for the long term. Why is cash flow important?Ĭash flow isn't only important to a company's current operations. For individuals and businesses, positive cash flow means having enough money to cover expenses or debts without overdrawing the account. You have deposits, money coming into your account, as well as withdrawals, money going out of your account.

In a more general sense, it's similar to balancing a checkbook. Organizations use cash flow to analyze their financial situations and help prepare for their futures. Cash flow is the movement of money out of and into a business.

0 kommentar(er)

0 kommentar(er)